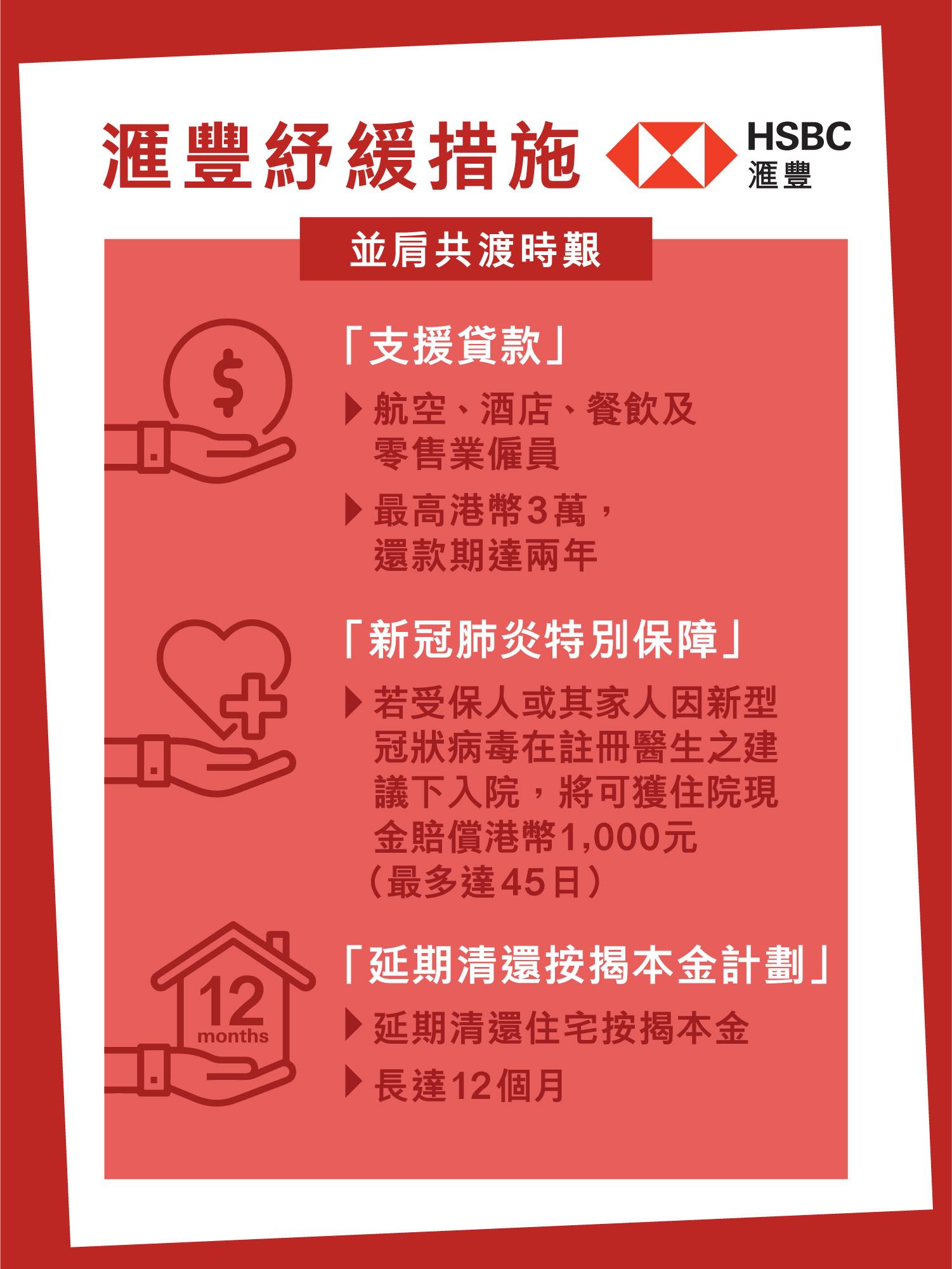

【滙豐紓緩措施 並肩共渡時艱】

因應新型冠狀病毒肺炎疫情,滙豐特別為個人客戶推出一系列嘅紓緩措施,與客戶一齊並肩同行,當中包括短期嘅個人財務安排,又有較長遠嘅保障,幫客戶減輕財政同埋現金流嘅壓力: 1.「支援貸款」– 為受僱於航空、酒店、餐飲及零售業嘅個人客戶,提供最高貸款額達港幣3萬,最多長達兩年還款期嘅「支援貸款」方案*。

2. 保險保障 – 滙豐保險早前已宣佈為所有人壽保險客戶及家人推出新型冠狀病毒嘅特別保障,例如延長保費寬限期及住院現金賠償。保障期為一年*。...

3.「延期清還按揭本金計劃」 – 受新型冠狀病毒疫情影響嘅現有按揭貸款客戶,可以按特殊財務需要申請長達12個月延期清還按揭本金* 。 想了解按揭 / 個人貸款詳情,請瀏覽 或致電2748 8080。

或致電2748 8080。

想了解保險詳情,請瀏覽 或致電2583 8000。

或致電2583 8000。

*受條款及細則約束 【Relief measures to support our community in time of need】

In response to the novel coronavirus outbreak, HSBC has introduced a series of supportive measures, including both short-term and long-term solutions, to help ease the financial burden on our personal customers: 1. Relief Loan – A cash loan of up to HKD30,000 for personal customers working in the airline, hotel, catering and retail industries, with a maximum tenure of two years*.

2. Insurance protection – Complimentary Novel Coronavirus benefits such as Extended Premium Grace Period and Hospital Cash Benefit for all life insurance customers of HSBC Life Hong Kong and their family members who are diagnosed with coronavirus for one year*.

3. Deferred Mortgage Principal Repayment Plan – allows existing mortgage customers with special financial needs due to the spread of Covid-19 to defer repayment of outstanding mortgage principal for up to 12 months*. To learn more about mortgage or personal loan, please click here or call 2748 8080.

or call 2748 8080.

To learn more about insurance, please click or call 2583 8000.

or call 2583 8000.

*Terms and conditions apply. 展开

因應新型冠狀病毒肺炎疫情,滙豐特別為個人客戶推出一系列嘅紓緩措施,與客戶一齊並肩同行,當中包括短期嘅個人財務安排,又有較長遠嘅保障,幫客戶減輕財政同埋現金流嘅壓力: 1.「支援貸款」– 為受僱於航空、酒店、餐飲及零售業嘅個人客戶,提供最高貸款額達港幣3萬,最多長達兩年還款期嘅「支援貸款」方案*。

2. 保險保障 – 滙豐保險早前已宣佈為所有人壽保險客戶及家人推出新型冠狀病毒嘅特別保障,例如延長保費寬限期及住院現金賠償。保障期為一年*。...

3.「延期清還按揭本金計劃」 – 受新型冠狀病毒疫情影響嘅現有按揭貸款客戶,可以按特殊財務需要申請長達12個月延期清還按揭本金* 。 想了解按揭 / 個人貸款詳情,請瀏覽

或致電2748 8080。

或致電2748 8080。想了解保險詳情,請瀏覽

或致電2583 8000。

或致電2583 8000。*受條款及細則約束 【Relief measures to support our community in time of need】

In response to the novel coronavirus outbreak, HSBC has introduced a series of supportive measures, including both short-term and long-term solutions, to help ease the financial burden on our personal customers: 1. Relief Loan – A cash loan of up to HKD30,000 for personal customers working in the airline, hotel, catering and retail industries, with a maximum tenure of two years*.

2. Insurance protection – Complimentary Novel Coronavirus benefits such as Extended Premium Grace Period and Hospital Cash Benefit for all life insurance customers of HSBC Life Hong Kong and their family members who are diagnosed with coronavirus for one year*.

3. Deferred Mortgage Principal Repayment Plan – allows existing mortgage customers with special financial needs due to the spread of Covid-19 to defer repayment of outstanding mortgage principal for up to 12 months*. To learn more about mortgage or personal loan, please click here

or call 2748 8080.

or call 2748 8080.To learn more about insurance, please click

or call 2583 8000.

or call 2583 8000.*Terms and conditions apply. 展开